Investment Risks

You are here

FAQ

For Investors

Investor Risks and Education Guide

Each investor is advised to consult legal, tax, investment or other professional before investing, and carefully review all the disclosures and documents provided as part of any offering materials. If in doubt, do not invest.

The purpose of this guide is to provide information to potential investors about the risks involved in buying securities in startup and mid-stage private and public companies. Please review the important information below before you begin to register on Manhattan Street Capital and before you make any investment commitment to companies on the MSC website.

This answer continuedSummary of Regulation A+ Title IV

Traditionally, investing in startups and other growth-stage companies has been the privilege of the wealthiest Americans. Accredited investors (people making $200,000 or more for two most recent years, or with a net worth of $1 million) were the only ones allowed by the Securities Exchange Commission to invest in startups. Investing is starting to see greater democratization, however.

In 2012, President Obama signed the American JOBS Act into law, which had 10 provisions to improve the working outlook and overall financial opportunities for Americans. Title IV of the JOBS Act, also referred to as Regulation A+, allows companies that want to raise between $3 million and $75 million* to do so from anyone – regardless of assets and income levels.

To see the rest of this FAQ, click on the blue button below:

This answer continuedMaking an investment usually doesn't take longer than 6-10 minutes. After you have completed the investment form, you can choose a payment method. Manhattan Street Capital provides a wide variety of payment options such as; debit cards, check, wire, ACH, and cryptocurrencies. Chose the one that fits you the most, follow the instructions and transfer the funds to the company you are investing in's special account. After the money is received you will be notified that your investment was received.

In most cases, the company you are investing in will process your investment quickly. If there is a requirement that investors must be accredited, then that process will wait on you proving the needed information.

Soon after you are requested to complete your subscription agreement the company accepting your investment will process your investment and issue you the securities you bought.

If the company you are investing in has a minimum total $ amount they must raise before they can raise any capital (this is unusual), then there may be a delay while they bring in sufficient investment $.

At any time you can email the company you are investing in or comment on their offering page to get answers to your investing questions.

If you would like to see the detailed description of the investing process, please read our related FAQ.

Related Content:

Regulation A+ (or “Reg A+”) is a new way to raise capital created by the Securities Exchange Commission (SEC). Effective March 25, 2015, SEC rules allow companies to test the attractiveness of their company offering to the investor market. This is the RegA+Audition(TM) on Manhattan Street Capital.

Since June 25, 2015, companies have been allowed to apply to make a Regulation A+ offering with the SEC and, when ready, raise capital in our platform and others. We are the first Regulation A+ platform. Manhattan Street Capital and FundAthena, a division of Manhattan Street Capital, will only fundraise for companies that we have reviewed and approved to list their offering on the "Company Offerings" Page.

To read complete answer click on the blue button below.

This answer continuedThe offerings on Manhattan Street Capital are free for investors, as the companies raising money pay the costs of the investment process in almost all cases.

Some companies choose to ask the investor to pay the debit card processing fee on their investment, most companies pay that fee for the investor. It is made very clear during the investment process if you are being asked to pay the debit card fee.

There are processing fees that can occur in the case of some payment methods, for example, your bank is likely to charge a $15 to $35 fee for a wire transfer and they may charge for ACH transfers - usually a few dollars many banks do not charge a sending fee on ACH transfers.

In a Reg A+ offering non-accredited investors can invest up to 10% of their annual income/net worth per year, whichever is the larger amount, (excluding their home).

To read complete answer click on the blue button below.

This answer continuedAn Accredited Investor is someone who is:

-

“A natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year;

-

“A natural person who has an individual net worth, or joint net worth with the person’s spouse, that exceeds $1 million at the time of investment, excluding the value of the primary residence of such person.”

After the next "closing" of the offering. Every investor whose investments have “cleared” by the time of the closing will be included in a disbursement. A company can conduct a series of “closes” (withdrawals of funds) throughout the duration of the campaign. If a company has a minimum capital amount that they must raise before they can withdraw funds from their escrow account then there may be a wait before their first closing - check their Offering Circular (for a Reg A+) or their PPM (for a Reg D).

After the "closing" the issuance of your securities will begin and you will be sent an email by the company you invested in. You will receive a communication when your securities are issued, along with instructions on how you can directly access your securities.

To view your investment status follow these steps:

- Login to your Manhattan Street Capital account

- Click on the 'Profile' icon in the top right-hand corner

- Select "Investment Dashboard"

Different stages of your investment

Pending

You have started an investment but haven't completed it yet. If you wish to complete your investment click the "Continue" button and fill out the form then submit the investment.

Not received

You have successfully submitted your investment, but we have not received the funds yet. Depending on the payment method this step can take up to a week or more in some cases.

Received

The investment has been received and your investment funds are now in the escrow/segregated account. When the company makes the next closing, your investment will be transferred to the company's bank and then the process for the issuance of your securities will begin.

Securities issuance started

You have signed the subscription agreement, and your investment has been accepted by the company. Your investment funds have been transferred from escrow to the company's bank account and the issuance of your securities has begun. You will receive a communication when your securities are issued, along with instructions on how you can directly access your securities.

Companies on the Manhattan Street Capital platform usually use these payment options:

Debit-cards, ACH, Check, and Wire transfer. Non-US investors can pay by credit card. Some companies choose not to use debit/credit cards.

Regulation A+ allows for two kinds of offerings, Tier 1, which spans from zero to $20 mill, and Tier 2 that spans from zero to $75 mill.

Tier 2 allows companies to raise from zero to $75 million per year from individual "Main Street" investors and accredited investors and institutions worldwide. The majority of companies choose Tier 2 because the Tier 1 requirement to get State by State Blue Sky exemption is very slow and very expensive. Companies using Tier 2 do not need to satisfy state Blue Sky requirements to raise capital (with some exceptions). Note that Tier 2 starts from a zero minimum for SEC purposes - I say this because there is a popular misconception that Tier 2 starts at $20 mill. That is not the case! Many companies make successful Tier 2 offerings of less than $20 mill.

To read complete answer click on the blue button below.

This answer continuedATS stands for Alternative Trading System. Regulatory change in recent years has brought the ATS type of securities exchange into existence.

An ATS is an after-market exchange where people who own securities can buy and sell.

This answer continuedRegulation A+ allows any investor, worldwide, to invest in private companies. This is a major change in US securities law, and it means that anyone can invest, if they choose to do so, in a Reg A+ offering, after it has been Qualified by the SEC. Before Reg A+ became effective in 2015, only wealthy, Accredited investors were allowed to invest in private companies.

To see the VIDEO, click on the blue button below.

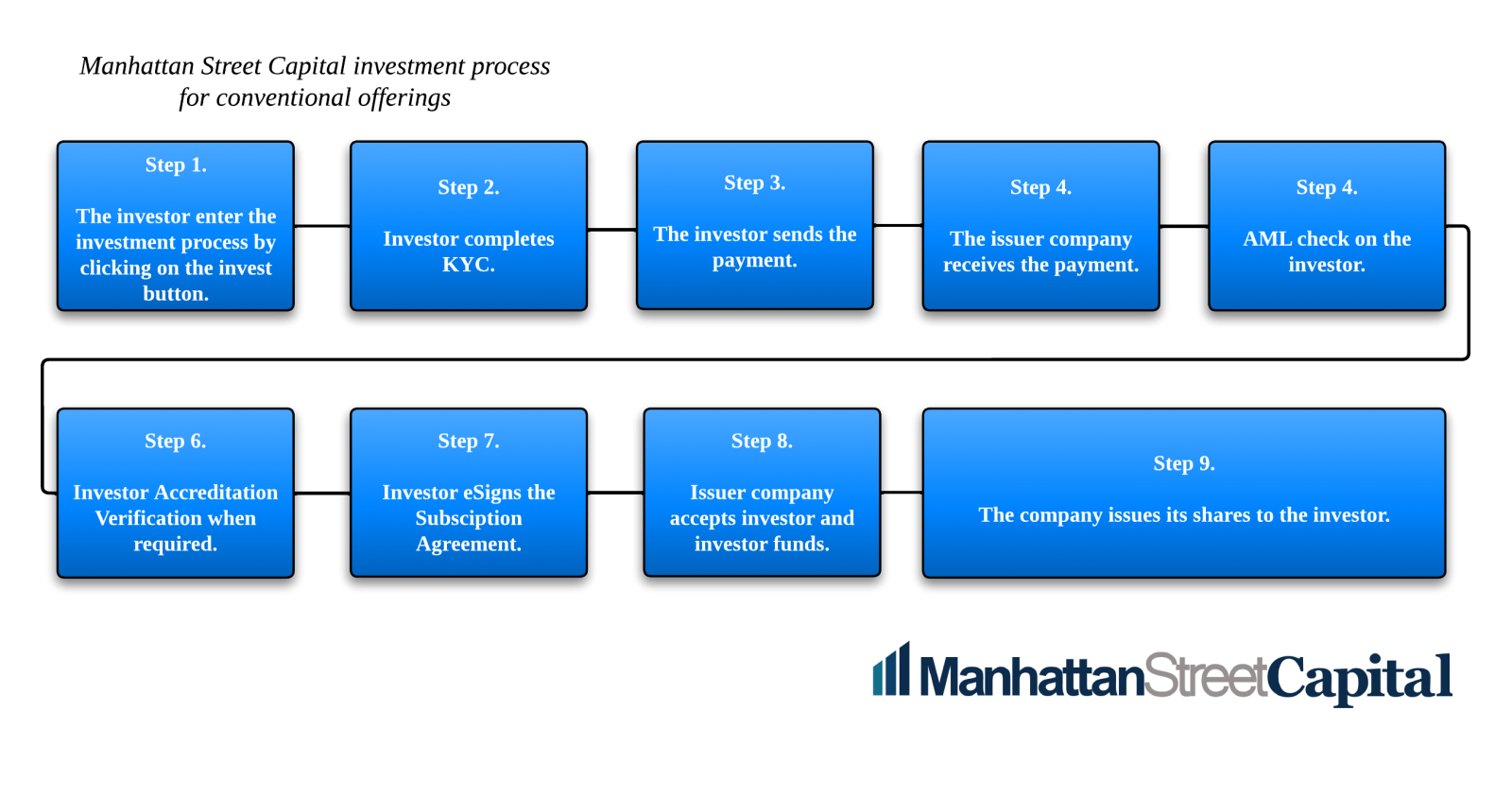

This answer continuedInvestment process for STOs and conventional offerings.

Step 1.

The investor enters the investment process by clicking on the "Invest Now" button on the offering page.

Step 2.

The investor completes the form and provides us with all the information that is needed to make an investment. This step doesn't take longer than 5-8 minutes.

Step 3.

The investor decides which payment method fits them the best, and send the payment. Manhattan Street Capital supports; Wire transfer, ACH, Debit and Credit card, Check.

Some companies may decide to only accept cryptocurrency payments.

Step 4.

The issuer company receives the payment. When the offering has a minimum raise amount, the money first gets deposited into the issuer company's escrow account and stays there, until the minimum amount gets exceeded.

Step 5.

Manhattan Street Capital runs an AML check on the investor to make sure that everything is fine.

Step 6.

In the case of Reg D offerings, the issuer company has to verify it's investors to be accredited. We have a built-in solution for this in our system to assist companies that retain us.

Step 7.

We send the subscription agreement to the investor who signs it.

Step 8.

The issuer company accepts investor and investor funds by countersigning the Subscription Agreement.

Step 9.

In the case of an STO, the company's Smart Contract issues the investor's tokens and transfers them to the investor's wallet. In a conventional offering, the company issues its shares to the investor.

If there is a minimum capital raise amount, the share or token issuance is delayed until the minimum is exceeded.

Related Content:

What much does a Regulation A+ offering cost?

Timeline schedule for Reg A+ IPO to the NASDAQ or NYSE

Reg A+ can be used for an IPO to the NYSE or NASDAQ and, starting in June of 2017 a significant number of companies have made their IPOs via Reg A+.

Click the blue button below for the whole of this FAQ.

This answer continuedUntil Reg A Plus it was very difficult for regular, “Main Street” investors to invest in startups, or any privately held business. You had to be an accredited investor with $1 million or more in net worth. To read complete answer click on blue button below.

This answer continuedManhattan Street Capital is a platform that enables companies to show and promote their offerings to individual and other investors. We give you open access to information about the companies as well as access to ask them questions so you can make a decision. Then our companies work with service providers like transfer agents and escrow banks and broker-dealers to assist when they exchange invested money into shares (or other securities) of stock (or other securities) To read complete answer click on blue button below.

This answer continuedAnyone! (see the exceptions below). Mainstreet investors worldwide can invest under Regulation A+ into companies that make their stock offerings with help from Manhattan Street Capita. Ordinary investors don’t have to be wealthy to invest! Investors are welcome from almost anywhere in the world.

The only limitation is that Main Street investors cannot invest greater than 10% of their annual income or 10% of their net worth, excluding their homes. This is a per-investor limit per company they invest in, and it only applies to Tier 2 offerings. Investors are allowed to self-verify their income and net worth. Issuers are not required to independently verify.

The inclusion of investors from “Main Street” who are not necessarily wealthy is the big deal here. Now companies can take investments from millions of people who could not participate before.

Accredited investors ($1 million or more in net worth) are not limited in how much they can invest. Investors from outside of the U.S. are welcome, with the same limits.

Please note that the regulations of your country may restrict you from investing via Reg A+ offerings. As an investor, you must check the regulations that apply to you, in your country. Subsequent to Regulation A+ rules being made effective in the USA, the Canadian regulators imposed limitations on Mainstreet Canadian investors, so most Reg A+ offerings do not accept Canadian Mainstreet investors. We have been advised that if a company gains prior approval from the Canadian States on a State by State basis, then Canadian main street investors would be allowed to invest via Reg A+.

Related Content:

Only Accredited investors are allowed to invest in Reg D offerings, this is a rule made by the SEC.

This answer continuedYou can find information about companies that are listed on Manhattan Street Capital by examining their offering page, their Offering Circular, and all the content available on their website and the internet too. You can also contact the company directly. And of course, we encourage you to dig deeply using the Internet and all resources available to you.

You must read the Offering Circular for companies that are conducting a Regulation A+ offering to become aware of the details.

This answer continuedPrincipal risk: Investing in start-ups will put the entire amount of your investment at risk. There are many situations in which the company may fail completely or you may not be able to sell the stock that you own in the company. In these situations, you may lose the entire amount of your investment. For investments in startups, total loss of capital is a highly likely outcome. Investing in startups involves a high level of risk and you should not invest any funds unless you are able to bear the entire loss of the investment.

To read complete answer click on the blue button below.

This is the list of the companies that completed their Reg A+ IPO and listed on the NYSE or NASDAQ

Arcimoto, Inc. - $19 million (NASDAQ),

to see the whole list, click the blue button below.

This answer continued

A security token is a token that is sold to investors via one of the SEC regulations - Reg D, Reg S, Reg A+ and Reg CF are good examples. A Registered S-1 IPO is another route.

To read complete answer click on the blue button below.

This answer continuedWhen you like the look of a company in its informal TestTheWaters(TM) stage, and if you would like to make a non-binding reservation, we call that "Reserve my Investment". The advantages to an investor are these:

If the company later completes a capital raise, then you will have booked yourself space in that offering at the IssuePrice(TM) (the price per share at which the shares are sold by the company).

To read complete answer click on the blue button below.

This answer continuedAn important part of Manhattan Street Capital is the open exchange of advice, suggestions and feedback from our investor community to the client offering companies. The more input you give to the companies, the better their offerings will become, and the more fun you will have, from the knowledge that you have helped, and by sharing the journey. By actively involving yourself, you will learn more about the company, the style of its leaders, and their strategy. It is a form of due diligence for you. And you get to help the companies that you interact with.

This answer continuedManhattan Street Capital's "Company Offerings" page is an interactive platform that gives companies the opportunity to market their offering and to engage with prospective investors. No investing is done in this stage. Also called TestingTheWaters(TM).

To read complete answer click on the blue button below.

This answer continuedRegulation A+ doesn’t require any limits on when you sell, though the offering company can do so (not expected often). Through a two-step process, an Issuer (company selling stock) can make their post offering Reg A+ shares tradable on one of the OTC, the NASDAQ or the NYSE markets. These markets -especially the NYSE- provides high liquidity to investors, so you can easily sell your shares, if you choose to.

SEE RELATED FAQs:

Can I keep my Reg A+ offering open continuously?

Manhattan Street Capital gives companies the opportunity to “TestTheWaters™” and get feedback from prospective investors to help improve offerings.

Companies can solicit non-binding IndicationsOfInterest(TM) of investment dollars from prospective investors. To read complete answer click on blue button below.

This answer continuedThis is our program to incentivize entrepreneurs to build startups that have the added clear objective of increasing employment to take charge of our future and cancel out many of the job losses that will be lost to the technology changes coming in our future already.

Click the Blue button for more on this topic:

This answer continued

The purpose of this page is to provide links to informative articles on the Metaverse.

- Why Corporate America Needs A Metaverse Investigator

- Metaverse 101: Defining the key components

- Metaverse real estate sales top $500 million, and are projected to double this year

- What is the metaverse? A beginner’s guide to virtual worlds

- What is the Metaverse? The Immersive, NFT-Powered Future Internet

- I’ve seen the metaverse – and I don’t want it

- How to Build a Better Metaverse

- ProShares Files Application With SEC for a Metaverse ETF

- Metaverse Real Estate Continues to Soar in 2022

- Some Predictions for How the Metaverse Will Impact Our Lives

- How to get ‘metaverse ready’: a beginner’s guide

- 10 Best Metaverse Cryptocurrency to Buy in 2022

Create a New Account with Computershare

If your offering has been set up to maintain shares electronically on ComputerShare, you may access your claims online. If you do not already have a Computershare account, please create one following the steps in this guide:

If you want to download a more comprehensive user's manual for ComputerShare, Click here

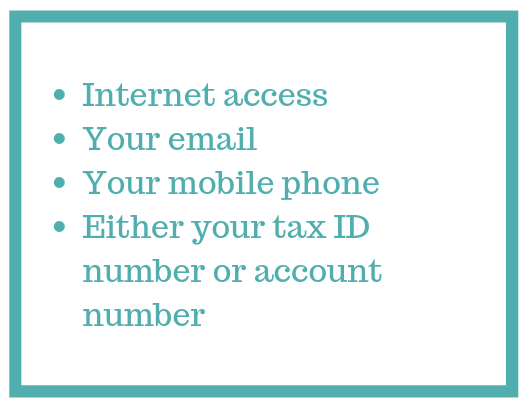

1) Before you begin, be sure to have these items ready and accessible.

2) Please note, if at any time you need assistance with logging into Investor Center beyond this guide, please get in touch with the Call Center:

.png)

3) To log in to Investor Center for the first time, please go to www.computershare.com/investor. Once you see this screen, be sure to select the second option: "CREATE LOG IN."

.png)

4) CONFIRM YOUR STOCK - Fill in the required validation information.

"Insitu Biologics Inc." is used as an example company name. Please type the name of the company that you own stock in.

.png)

5) REGISTRATION- Please provide your information and set your login credentials.

(1).png)

6) VERIFY YOUR EMAIL - At this point, you will need to log into your email account and verify your email. Once you've completed that step, return to this screen and select "I HAVE CONFIRMED MY EMAIL" VERIFY YOUR EMAIL - At this point, you will need to log into your email account, and verify your email. Once you've completed that step, return to this screen and select "I HAVE CONFIRMED MY EMAIL."

.png)

7) Welcome to Investor Centre - At this point, you've successfully created an account with Computershare. Welcome to Investor Centre - At this point, you've successfully created an account with Computershare.

.png)

8) VERIFY YOUR IDENTITY - Computershare will need to confirm your identity to protect your account and info. You can choose to either log out at this point and wait for a verification code via mail, or if you'd like immediate access, you can select "VERIFY IDENTITY ONLINE" and follow the prompts to verify your identity. VERIFY YOUR IDENTITY - Computershare will need to confirm your identity to protect your account and info. You can choose to either log out at this point and wait for a verification code via mail, or if you'd like immediate access, you can select "VERIFY IDENTITY ONLINE" and follow the prompts to verify your identity.

.png)

9) That's it! Please note that If you did not choose to verify online or were not eligible, you would need to return to the website and enter the access code provided once you receive it in the mail. If you still need assistance, please call the call center at the numbers listed at the start of this guide.

.png)

How does the investment process work on Manhattan Street Capital?How long does it take for my investment to complete?

How do I know if I'm an accredited investor?

When will I receive my shares?

How can I view the status of my investment?

Is there any cost to investing on Manhattan Street Capital?

Who can invest in a Reg A+ offering?

QIBs are institutional investors that own or manage at least $100 million worth of securities, or are registered broker-dealers with at least a $10 million investment in unrelated securities.This answer continued

Refunds

Can I cancel my investment and get a refund?

Yes. You can change your mind anytime up to 48 hours after you invested and you will receive a full refund, including any fees.

How will I receive a refund?

When you cancel your investment a refund will automatically be sent back to the bank account or credit card that was used to make the investment. If you sent a check or a wire, you will receive an email with instructions to send us your wire or bank account info before we can send the refund.

How long will it take to receive my refund?

We initiate refunds as we receive them, but it can take up to 14 days to reach you, especially if you invested with a check or wire.

What are the limits on canceling an investment?

Once the 48 hour window has passed, you no longer can cancel your investment or obtain a refund.

Can the company not accept my investment?

Yes. Companies may choose not to accept your investment for any reason. One reason may be that they discovered you worked for a major competitor.

After the round closes, and the company has countersigned the contract and received the funds, your investment can no longer be canceled.

FundAthena is a division of Manhattan Street Capital.

In Greek mythology, Athena was the goddess of wisdom, intellect, and heroic endeavor. She was a stalwart partner to many Greek God figures, helping them succeed. In the same way, FundAthena is a partner for companies with top-notch gender diverse and women-led teams, helping guide them and match them with the funding, business strategy, project management and coordination support they need to accelerate their businesses.

This answer continuedWith Kickstarter, individuals donate money to help fund creative projects or pre-order products before they come to market, but those contributors have no ownership. With Manhattan Street Capital, companies are selling shares or borrowing money from the investor, with terms that vary between companies.

This answer continued- RatedResources™: Resources suggested by members to accelerate the state of readiness for raising capital.

- CrowdAnalyst™: Analysts follow companies in the marketplace, research the market and competitors, and make forecasts of the companies' revenues and profits. The program is designed for a stable share price in the aftermarket.

- TestTheWatersAudition(TM): Informal way to test market a company offering at low cost to evaluate interest from investors, before spending money on audits etc

- TestTheWaters(TM): The SEC allows companies to test market their offerings before filing for a Reg A+ offering.

- This answer continues, click the blue button below: